As a real estate professional, it is essential to understand the correlation between various metrics to provide valuable insights to both buyers and sellers.

Firstly, the Months Supply of Inventory is a key indicator of market conditions. With a value of 5.52, this suggests that there is a balanced market where supply and demand are relatively in equilibrium. However, the 12-Month Change in Months of Inventory has increased by a significant 31.12%, indicating a shift towards a buyer’s market. This may lead to increased competition among sellers and potentially lower prices.

The Median Days Homes are On the Market is 41, which is a relatively short period. This suggests that homes are selling quickly, likely due to high demand and limited inventory. Additionally, the Sold to List Price Percentage of 96.5% indicates that sellers are generally receiving offers close to their asking price.

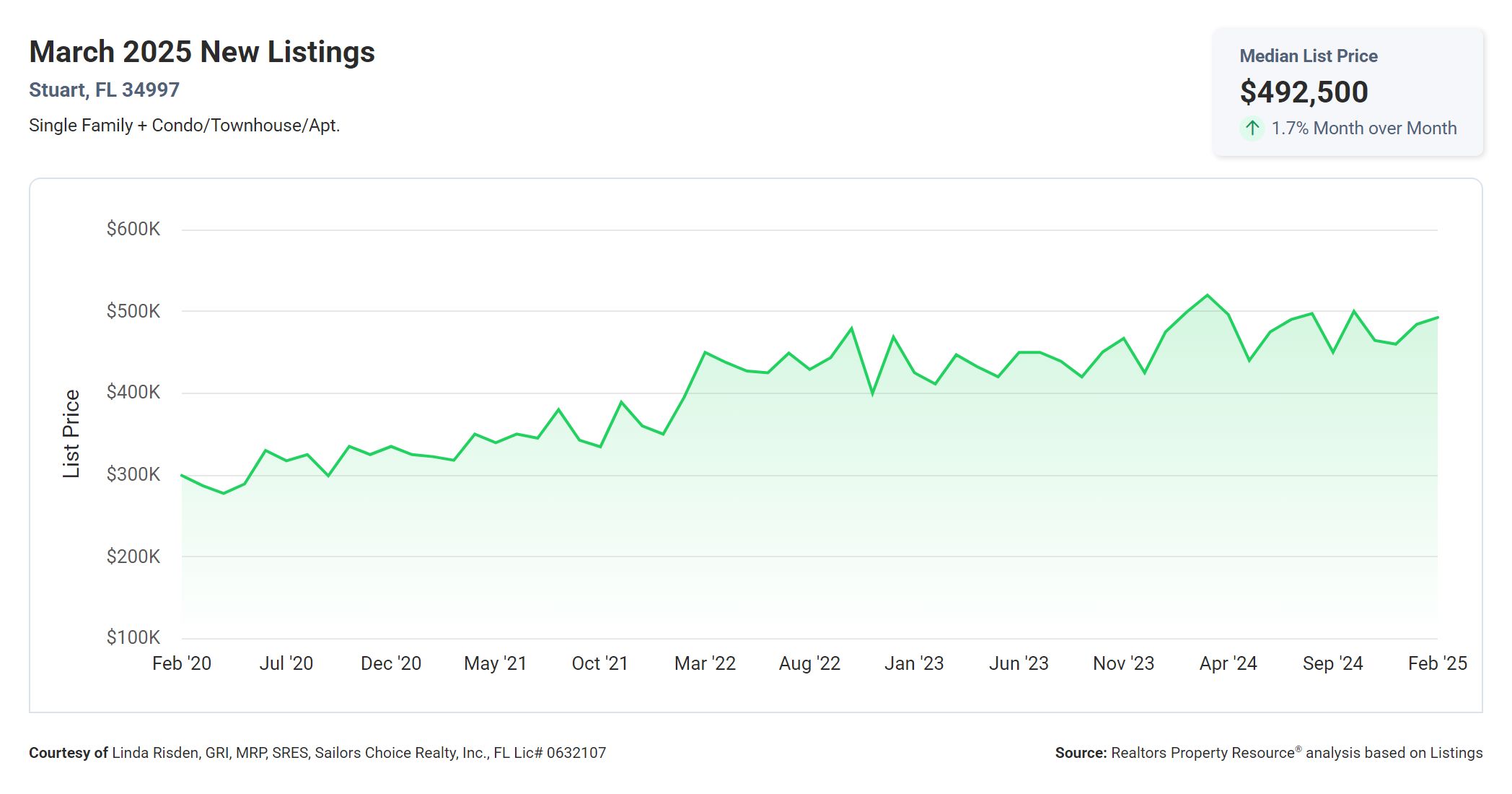

Finally, the Median Sold Price of $500,000 provides a benchmark for both buyers and sellers to understand the current market value of properties in the area. This figure, combined with the other metrics, can help inform decisions on pricing strategies, negotiation tactics, and timing for both parties.

In conclusion, the correlation between these real estate metrics paints a picture of a market with balanced inventory levels, quick sales, and strong pricing. Buyers may need to act quickly to secure a property, while sellers may benefit from pricing competitively and being prepared for negotiation. Overall, understanding these metrics can help all parties navigate the real estate market effectively.

Looking to Buy or Sell anytime soon? Let’s Chat

Linda Risden

[email protected]

772-529-5538